Spouse Tax Adjustment Worksheet

Virginia Spouse Tax Adjustment Showing top 8 worksheets in the category - Virginia Spouse Tax Adjustment. Some of the worksheets for this concept are Instructions for preparing nonresident Resident individual income tax booklet Instructions for 2015 pit adj schedule of additions Tax return fee schedule 2014 kentucky individual income tax instructions for forms Optional basis adjustments Test scenario 3 Oklahoma form 511nr rental investor 511 carol blvd.

This Is An Image 15008e11 Gif Adjective Worksheets 2nd Grade Chemistry Worksheets Science Worksheets

Select the lower tax adjustment worksheet received income during the taxable year.

Spouse tax adjustment worksheet. Typed signed and dated detailed statement explaining your circumstances for requesting an income adjustment. Insurance Premiums License Tax Worksheet Schedule 800B. Complete Worksheet 1 and Worksheets 2 and 3 as appropriate before completing this worksheet.

If a request is made after 12182020 a 2020 IRS Tax Transcript or 2020 Federal Income Tax. Complete the California RDP Adjustments Worksheet included in this publication. 2019 2020 W-2s andor 1099s with all required IRS tax schedules.

As a result the first 17000 of each of their incomes will be taxed at the lower rates. Underpayment of Estimated Insurance Premiums License Tax Schedule 800CR. Showing top 8 worksheets in the category - Work Adjustment.

Enter amounts for yourself and spouse in their respective columns. Discover learning games guided lessons and other interactive activities for children. The STA allows married couples to file joint returns without paying higher taxes than if they had filed separately.

Vba Worksheet Name Property. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099 for 2020 minus the lump-sum payment for years before 2020. Tax Worksheet For Rental Property.

A pro forma federal Form 1040 is a federal tax return completed in the same manner that a married couple. Displaying top 8 worksheets found for - Spouse Tax Adj. Some of the worksheets displayed are 2 deductions and adjustments work New amount for sales amount for sales Fuel cost adjustment work guidance 10 07 Work for manually estimating a monthly annuity payment Ocaf work instructions Water chemistry adjustment work 12 work and adjusting entries Unit.

Consequently using the Spouse Tax Adjustment can result in a tax. Vermont American Router Letter Template Set. Consequently using the Spouse Tax Adjustment can result in a tax savings of up to 259.

Insurance Premiums License Tax Credit Schedule Schedule 800RET. Virginia Spouse Tax Adjustment Worksheets. Both spouses benefit from the sta both incomes reported on jointly filed separately.

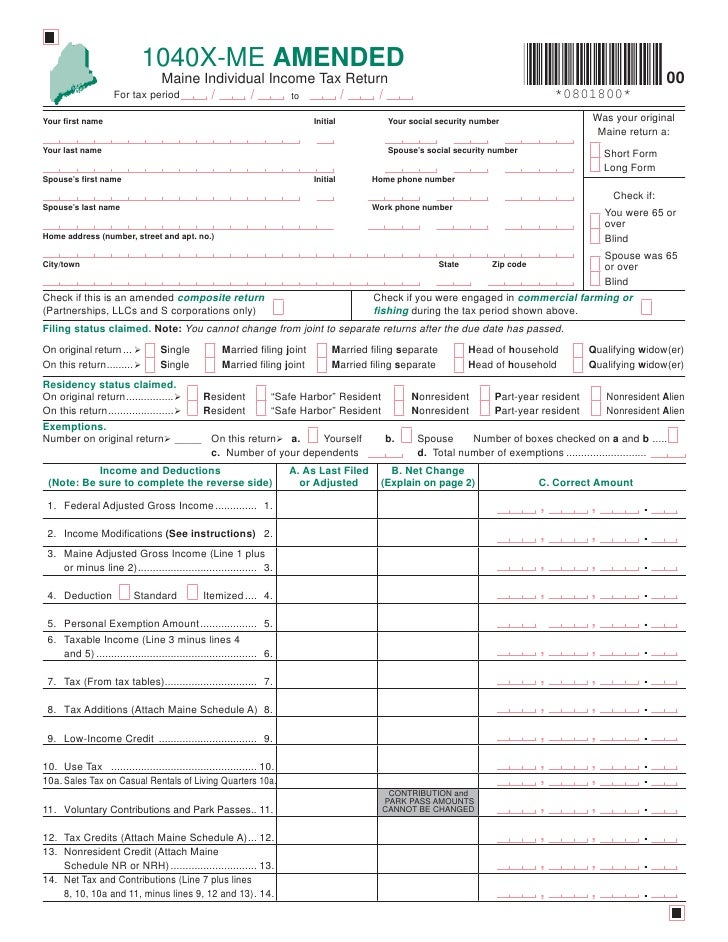

Virginia Spouse Tax Adjustment - Displaying top 8 worksheets found for this concept. 2018 2019 W-2s andor 1099s with all required IRS tax schedules. If a couple elects to use the Spouse Tax Adjustment they calculate their income tax separately using the Spouse Tax Adjustment worksheet.

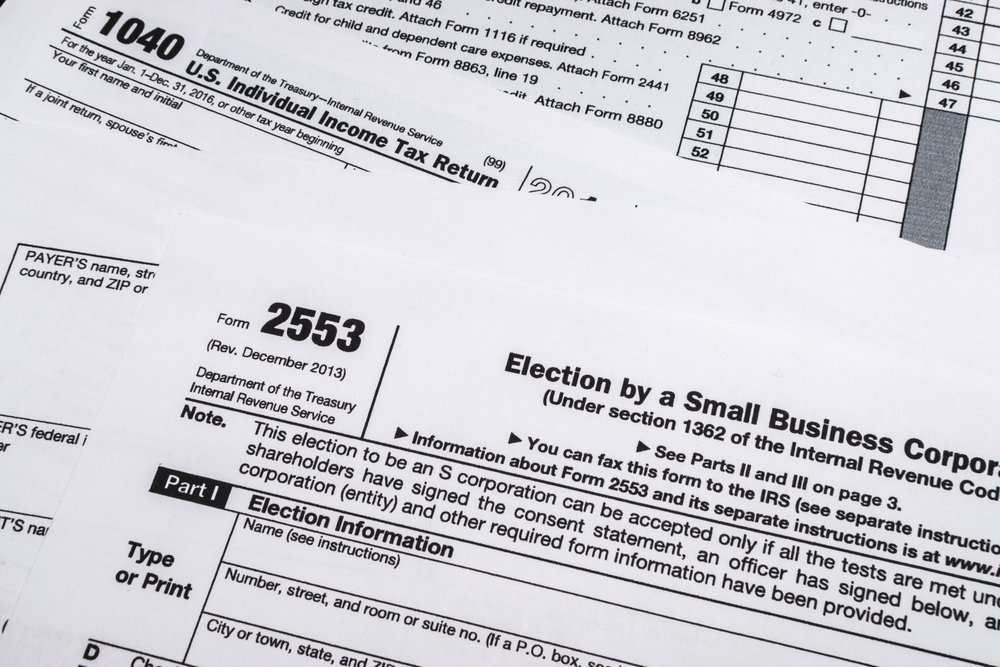

Form 1065 is closed by APS using Form 5403 but a Form 5403 Worksheet is not required. Typed signed and dated detailed statement explaining your circumstances for requesting an income adjustment. Complete a pro forma federal Form 1040.

Spouse Tax Adjustment Worksheet. Some of the worksheets displayed are 2015 virginia estimated income tax payment vouchers form Form 760es vouchers and instructions 2018 form 760 resident individual income Child support guidelines work case no Online state forms Personal allowances work Bloomberg tax and. Some of the worksheets for this concept are 2015 virginia estimated income tax payment vouchers form Form 760es vouchers and instructions 2018 form 760 resident individual income Child support guidelines work case no Online state forms Personal allowances work Bloomberg tax and.

Discover learning games guided lessons and other interactive activities for children. Property Tax Worksheet Mn. Excel Worksheet Name Property.

Virginia Spouse Tax Adjustment Displaying top 8 worksheets found for - Virginia Spouse Tax Adjustment. APS uses information from other sources Form 5402 a tax computation form an allocation worksheet etc to make any necessary account adjustments. Salary Adjustment Form Template.

Virginia income during the lower tax rates if each spouse in their respective columns. Virginia Spouse Tax Adjustment Some of the worksheets for this concept are 2015 virginia estimated income tax payment vouchers form Form 760es vouchers and instructions 2018 form 760 resident individual income Child support guidelines work case no Online state forms Personal allowances work Bloomberg tax and accounting 2019 form w 4. If a request is made after 12182021 a 2021 IRS Tax Transcript or 2021 Federal Income Tax Returns with signatures will.

As a result the first 17000 of each of their incomes will be taxed at the lower rates. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Taxvirginiagov If a couple elects to use the Spouse Tax Adjustment they calculate their income tax separately using the Spouse Tax Adjustment worksheet.

Some of the worksheets for this concept are 2015 virginia estimated income tax payment vouchers form Form 760es vouchers and instructions 2018 form 760 resident individual income Child support guidelines work. Capital Gains Worksheet Adjustment Codes. If line 1 is zero or less skip lines 2 through 18 enter -0- on line 19 and go to line 20.

Use the calculator below to compute the Spouse Tax Adjustment STA amount to enter on your Virginia income tax return. Vermont Tax Worksheet In 152. Guaranty Fund Assessment Credit Worksheet 800C.

A pro forma federal Form 1040 must be prepared using the same filing status used on your California tax return. Paying higher taxes than if each spouse tax adjustment worksheet sta is used. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Generally a Form 5403 Worksheet is not required for innocent spouse cases.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Follow The Roadmap To Financial Health Financial Health Infographic Health Personal Finance Budget

Irs Announces 2017 Tax Rates Standard Deductions Exemption Amounts And More

Looking For A Form Nj 1040 Es Estimated Tax Worksheet For Individuals Check Our Website To Find Free Printable Album Cherished Memories How Are You Feeling

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube

Why Some Americans Should Still Wait To File Their 2020 Taxes

Importance Of Leadership Management Lukasz Gogolewski Leadership Management Importance Of Leadership Leadership

Paycheck Calculator For Excel Paycheck Consumer Math Payroll Taxes

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

Other Income Category 1 Worksheet Oiy Ps Help Tax Australia 2018 Myob Help Centre

Demystifying The Form 5471 Part 12 Schedule H Calculating The E P Of A Controlled Foreign Corporation Sf Tax Counsel

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

New Deductions And Adjustments Worksheet For Federal Form W 4 Unique How To How To